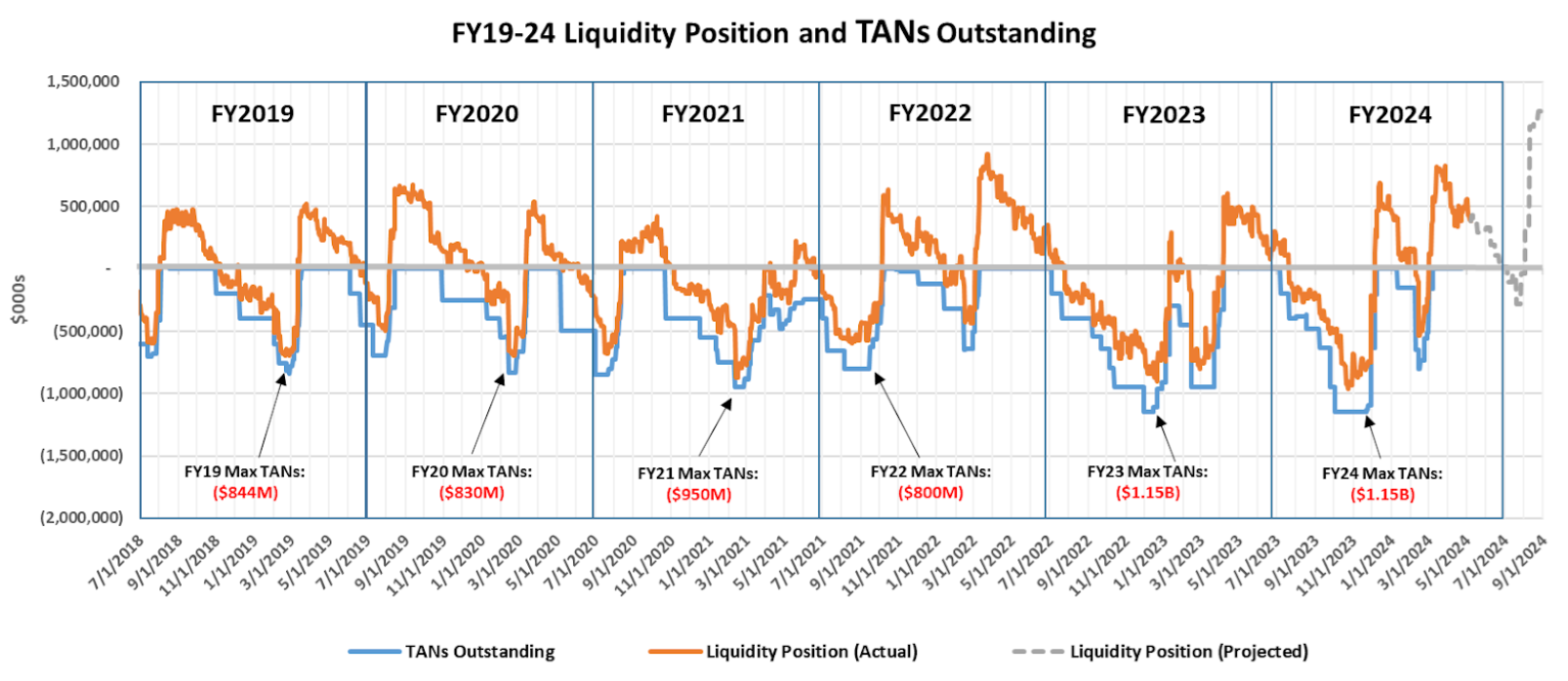

Chicago Public Schools (CPS) does not receive revenues when it pays expenses. As a result, CPS’ cash flow experiences peaks and valleys throughout the year, depending on when revenues and expenditures are received and paid. Furthermore, revenues are generally received later in the fiscal year, while expenditures, which are predominantly payroll, are level across the fiscal year––with the exception of debt service and pensions. The timing of these two large payments (debt service and pensions) occurs just before major revenue receipts of property taxes. These trends in revenues and expenditures, accompanied by a weak cash balance that is not large enough to absorb the differences, put constant cash flow pressure on the District and necessitate the use of cash flow borrowing in the form of Tax Anticipation Notes (TANs) during many parts of the year.

The use of TANS as a result of cash flow timing for CPS during FY2024 was similar to the previous fiscal years. TANs were used for most of the year to provide needed liquidity. CPS had a maximum amount of $1.15 billion in TANs outstanding in FY2024 just prior to the delayed due date of the second installment of FY2023 property taxes on December 1st. The use of TANs in FY2025 will not be eliminated because year-end cash balances have not increased to a targeted level that would be enough to fund operations for just more than 60 days past year end when the second installment of property taxes are typically due and begin to be received by CPS on August 1st in order to replenish liquidity. Approximately $600 million greater than recent year-end cash position amounts would be needed in order to achieve this at current FY25 budget levels of expenditures.

In FY2024, approximately $4.5 billion, or 59 percent of CPS’ current year revenues, excluding non-cash items, were received after February - more than halfway into the fiscal year. The annual debt service payment of $503 million was made in mid-February, just prior to the receipt of approximately $1.6 billion of the first installment of property tax revenues. The annual Chicago Teachers’ Pension Fund (CTPF) pension payment must be made by the end of the fiscal year in late June, just before CPS receives the second installment of property taxes. In FY2024, CPS will be required to pay approximately $60 million from operating revenues because the pension property tax levy does not cover the entire amount of the CPS portion of the actuarially required payment vs. FY2023 when the same CPS amount was made entirely by the tax levy.

Historically, approximately 56 percent of the annually budgeted CPS expenditures are for payroll and associated taxes, withholding, and employee contributions. In addition, recurring expenses for educational materials, charter school payments, health care, transportation, facilities, and commodities total approximately 24 percent of annual budgeted expenditures. The timing of these payments is relatively predictable and spread throughout the fiscal year. Approximately 20 percent of budget revenues, which flow through the operating account, comprise debt service, annual pension payments, and interest on short-term debt for cash flow borrowing.

Most organizations set aside cash reserves to weather these peaks and valleys in cash flow. In the years prior to revising the state aid formula in FY2018, CPS depleted its cash reserves and has still been attempting to rebuild the balances. Since FY2022, each fiscal year has ended on June 30th with a positive cash position and no TANs outstanding. However, the year-end cash position has been small relative to the overall size of the budget. More work is still needed as there is not enough cash on hand to last approximately 30-45 days until property tax receipts are typically received in August, and TANs must continually be used to bridge the gap.

Cash Inflows

CPS has four main sources of operating cash inflows: local, state, and federal revenues and working capital short-term borrowing.

- Local Revenues: Local revenues are predominantly property taxes. In FY2024, CPS will receive approximately $3.8 billion of property taxes, of which $3.1 billion will be allocated to the operating fund, $557 million will be distributed to the CTPF through the pension tax levy, and $51 million will be used to fund capital projects through the Capital Improvement Tax levy. Property tax revenues are received from Cook County in two installments. 96 percent of the property tax monies are received from February onward, which is over halfway through any given CPS fiscal year. The first installment of approximately $1.6 billion was due March 1 and was received into the main operating account in late February and March. If tax bills are not delayed again, the second property tax installment to be counted as FY2024 revenues in the amount of approximately $1.5 billion is anticipated to be received in late July and August. In FY2023, the second installment tax penalty date was moved to December 1, 2023, which caused approximately $1.6 billion of property tax receipts to be delayed by approximately 120 days. Property tax receipts have grown from $2.35 billion in FY2012 to $3.80 billion in FY2024—a compounded growth rate of 3.8 percent. PPRT revenue declined by approximately 40 percent compared to FY2023 through June, contributing to less cash at the end of the year.

- State Revenues: State revenues largely comprise Evidence-Based Funding (EBF) and state grants. EBF is received regularly from August through June in bi-monthly installments. In FY2024, EBF totaled approximately 69 percent of the state revenues budgeted by CPS, up from 57 percent in FY2017 before EBF was created. This increase improves cash flow due to the consistency of the payments. Block grant payments are distributed sporadically throughout the year, with the majority of them being received before June 30th.

- Federal Revenues: The state administers categorical grants on behalf of the federal government once grants are approved. As of May 28, 2024, CPS has received approximately $659 million of ESSER III revenues in FY2024. Approximately 57 percent of this revenue was received before January 1, 2024.

- Working Capital Short-Term Borrowing: Under State statute and with Board approval, CPS can issue short-term debt in the form of TANs to address liquidity issues. Borrowing with short-term TANs provides upfront money to pay for expenditures when cash is unavailable, and they allow for repayment of the borrowings when property tax revenues are eventually received. In FY2024, CPS issued a maximum amount of $1.15 billion in TANs to support liquidity, which was the same maximum outstanding as in FY2023. As of June 30, 2024, no TANs are projected to be outstanding for the third consecutive fiscal year-end. This has been caused by a combination of factors, including a higher fund balance and an underlying cash position, federal stimulus revenues, and other timing of revenues and expenditures. TANs are repaid from the District’s property tax levy used to fund operations. To support liquidity in FY2025, CPS is prepared to issue TANs against property taxes as needed, which will allow liquidity to be maintained throughout the year. Short-term borrowing requires that CPS pays interest on the amounts borrowed. For FY2025, approximately $9.5 million in interest costs for TANs will be budgeted.

Cash Expenditures

CPS expenditures are largely predictable, and the timing of these expenditures can be broken down into three categories: payroll and vendor, debt service, and pensions.

- Payroll and Vendor: Historically, approximately $4.3 billion of CPS’ expenditures are payroll and associated taxes, withholding, and employee contributions. These payments occur every other week, and most expenditures are paid from September through July. In recent years, approximately $2.9 billion of CPS vendor expenses are also relatively stable across the year.

- Debt: A debt service deposit for the payment of bonds that have been issued to fund capital improvements is required to be made once a year each February 15th from the State aid EBF revenue that CPS receives. In FY2024, the CPS debt service deposit from EBF was approximately $503 million in February. The timing of this debt service deposit comes just before CPS received approximately $1.6 billion in property tax revenues. In addition to EBF, a portion of the debt service on the bonds that have been issued is paid by personal property replacement taxes and/or property taxes deposited directly with the trustee, meaning they do not pass through the District’s operating fund from a cash perspective. The bond documents dictate the timing and amount of these payments. Once the trustees have verified that the debt service deposit is sufficient, they provide a certificate to the CPS, which then allows the backup property tax levy that supports the bonds to be abated.

- Pensions: In FY2024, CPS will contribute approximately $60 million to the CTPF by the fiscal year-end on June 28, 2024, from unrestricted operating funds. Additionally, in FY2024, the dedicated pension property tax levy will directly intercept and deposit approximately $557 million in revenue to the CTPF. These revenues do not pass through the District’s operating funds from a cash perspective (see the Pensions chapter for more detail on FY2024 funding sources). CPS also contributed $175 million in the spring of 2024 to the Municipal Employees’ Annuity and Benefit Fund (MEABF) due to the City no longer picking up CPS' full employer pension costs.