Chicago Public Schools (CPS) does not receive revenues when it pays expenses. As a result, CPS’ cash flow experiences peaks and valleys throughout the year, depending on when revenues and expenditures are received and paid. Further, revenues are generally received later in the fiscal year, while expenditures, mostly payroll, are level across the fiscal year––with the exception of debt service and pensions. The timing of these two large payments (debt service and pensions) occur just before major revenue receipts. These trends in revenues and expenditures put cash flow pressure on the District.

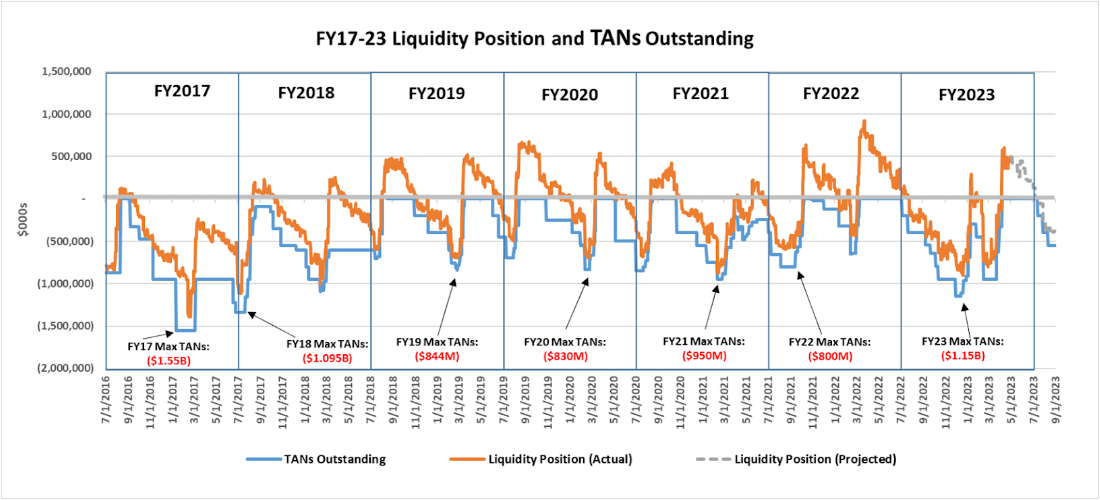

CPS continued to make progress on improving its cash flow during FY2023, and projects no Tax Anticipation Notes (TANs) will be outstanding at the end of the fiscal year. This is the second consecutive fiscal year with no TANs outstanding on June 30th. The second installment of property taxes for Tax Levy Year 2022 was delayed from August 1, 2022, to December 30, 2022, because of the County’s implementation of a new computer system. This significant five-month change in the due date delayed approximately $1.5 billion of revenues for the Board. In order to react to the delayed property tax revenues in FY23, the maximum TANs outstanding increased by $300M compared to the prior year. CPS can continue to further decrease its reliance on TANs in FY24 if property tax bills are due on time.

In FY2023, approximately $5.0 billion, or 69 percent of CPS’ current year revenues, excluding non-cash items, were received after February - more than halfway into the fiscal year. The annual debt service payment is made in mid-February, just prior to the receipt of approximately $1.5 billion of the first installment of property tax revenues. The annual Chicago Teachers’ Pension Fund (CTPF) pension payment must be made by the end of the fiscal year in late June, just before CPS receives the second installment of property taxes.

Historically, approximately 58 percent of the Chicago Board of Education’s budgeted expenditures are for payroll and associated taxes, withholding, and employee contributions. In addition, the Board’s recurring expenses for educational materials, charter school payments, health care, transportation, facilities, and commodities total approximately 33 percent of the Board’s budgeted expenditures. The timing of these payments is relatively predictable and spread throughout the fiscal year. Approximately 19 percent of budget revenues, which flow through the operating account, comprise debt service, annual pension payments, and interest on short-term debt.

Most organizations set aside cash reserves to weather these peaks and valleys in cash flow. In the years prior to the revision of the state aid formula in FY2018, the Board depleted its cash reserves and has still been attempting to rebuild the balances. The Board ended FY2022 with a positive cash balance and no TANS outstanding for the first time in eight years and expects to build upon this in FY2023. However, more work is still needed as there is not enough cash on hand to last until property tax receipts are typically received in August.

Cash Inflows

CPS has four main sources of operating cash inflows: local, state, and federal revenues and working capital short-term borrowing.

- Local Revenues: Local revenues are largely made up of property taxes. In FY2023, CPS will receive approximately $3.63 billion of property taxes, of which $2.8 billion was issued to the Board’s operating fund, $552 million was distributed to the CTPF through the pension levy, and $56 million was allocated to capital projects through the Capital Improvement Tax levy. The Board receives property tax revenues in two installments, 96 percent of which are received from February onwards, over halfway through the fiscal year. The first installment of approximately $1.5 billion was due April 3 and was received into the main operating account in late March and April. The second installment of approximately $1.4 billion is anticipated to be received past July or August, depending on the deadline. In FY2022, the second installment tax penalty date was moved to December 30, 2022, which caused approximately $1.5 billion of property tax receipts to be delayed by approximately 150 days. Property tax receipts have grown from $2,352 million in FY2012 to $3,685 million in FY2023—a compounded growth rate of 3.8 percent.

- State Revenues: State revenues largely comprise Evidence-Based Funding (EBF) and state grants. EBF is received regularly from August through June in bi-monthly installments. In FY2023, EBF totaled approximately 71 percent of the state revenues budgeted by CPS, up from 57 percent in FY2017 before EBF was created. This increase improves cash flow due to the consistency of the payments. Block grant payments are distributed sporadically throughout the year, with the majority of them being received before June 30th.

- Federal Revenues: The state administers categorical grants on behalf of the federal government once grants are approved. As of May 19, 2023, CPS has received approximately $876 million of ESSER III revenues in FY2023. Approximately 79 percent of this revenue was received before January 1, 2023.

- Working Capital Short-Term Borrowing: The District can issue short-term borrowing to address liquidity issues. Short-term borrowing allows the Board to borrow money to pay for expenditures when cash is unavailable and repay the borrowing when revenues become available. State statute allows CPS to issue this type of cash flow borrowing through TANs. In FY2023, CPS issued a maximum of $1.15 billion in TANs to support liquidity. As of June 30, 2023, no TANs are projected to be outstanding for the second consecutive year. This improvement was caused by a combination of factors, including a higher fund balance, federal stimulus revenues, and other timing of revenues and expenditures. TANs are repaid from the District’s operating property tax levy. To support liquidity in FY2024, CPS is prepared to issue TANs against the second installment of property taxes as needed, allowing the Board to maintain liquidity despite the uncertainty of the timing of the property tax revenues. Short-term borrowing requires that CPS pays interest on these bonds. In FY2024, the Board budgeted approximately $19.5 million in interest costs for the TANs.

Cash Expenditures

CPS expenditures are largely predictable, and the timing of these expenditures can be broken down into three categories: payroll and vendor, debt service, and pensions.

- Payroll and Vendor: Historically, approximately $4.1 billion of CPS’ expenditures are payroll and associated taxes, withholding, and employee contributions. These payments occur every other week, and most expenditures are paid from September through July. Approximately $2.8 billion of CPS vendor expenses are also relatively stable across the year.

- Debt: Long-Term debt service is deposited into debt service funds managed by independent bond trustees. These debt service deposits are backed by EBF and are deposited once a year. In FY2023, the debt service deposit from EBF was approximately $502 million in mid-February. The timing of this debt service deposit comes just before CPS received approximately $1.5 billion in property tax revenues. The remainder of the bonds are paid by personal property replacement taxes and/or property taxes deposited directly with the trustee, meaning they do not pass through the District’s operating fund from a cash perspective. The bond documents dictate the timing and amount of these payments. Once the trustees have verified that the debt service deposit is sufficient, they provide a certificate to the Board, which allows the Board to abate the backup property tax levy that supports the bonds.

- Pensions: In FY2023, no contribution from operating funds is anticipated to be made to the CTPF by June 30, 2023, due to a favorable investment return by the fund in their previous fiscal year. Approximately $12 million of pension payments were made to the CTPF previously during FY2023. In FY2023, a dedicated pension levy will directly intercept $552 million in revenue to the CTPF—these revenues do not pass through the District’s operating funds from a cash perspective. FY2023 will mark the first time that the dedicated pension levy and state funding for pensions will cover the entirety of CPS’ obligation. However, a significant increase to the certified cost in FY2024 will force the district to divert unrestricted revenues once again to cover a portion of the cost. (See the Pensions chapter for more detail on FY24 funding sources.) The Board contributed $175 million in the spring of 2023 to the Municipal Employees’ Annuity and Benefit Fund (MEABF) due to the City no longer picking up CPS' full employer pension costs.

Forecasted Liquidity

The chart below provides CPS’ liquidity profile from FY2017 to FY2023. As shown in the chart below, the liquidity position is positive at the end of the fiscal year.

Chart 1: FY2017–FY2023 Operating Liquidity Position