Chicago Public Schools’ finances, like districts across the country, have been impacted by the COVID-19 pandemic. The FY2022 revenue budget reflects the unanticipated and historic changes to revenue sources that are the result of the COVID-19 pandemic. As a unit of local government, CPS’ sources of revenue are categorized by the level of government (local, state, and federal) that collects, distributes, or grants resources to the district––all of which have been impacted by the pandemic.

The largest share of local revenue comes from the Chicago Board of Education’s ability to tax residents on the value of their property. The stability of this revenue source is vital to the financial health and viability of the district. Property taxes are the most general and unrestricted funds allocated to CPS schools and departments. CPS’ ability to extend taxes is governed by PTELL, or the Property Tax Extension Limitation Law, which limits the amount CPS can increase its property tax levy by the lesser of the change in the Consumer Price Index (CPI) or 5 percent. The County Assessor’s office responded to the pandemic’s impact on the job and housing market by instituting an automatic reduction, also referred to as the COVID Adjustment, in the value of property and subsequent tax bills owed. The lack of growth in the base value of property means that CPS will see property tax revenue gains lower than in previous years.

The largest portion of state funding is allocated to CPS and other Illinois districts through Evidence-Based Funding, or EBF. The EBF model allocates additional funding through a tiering system that directs new investments in state education funding to districts most in need of resources. At the end of the recent state legislative session, the General Assembly passed a state budget that includes a $362.1 million increase to EBF funding, despite an earlier recommendation in the Governor’s budget proposal, later reversed, to keep EBF funding flat to FY2021 levels. As an under-resourced district, CPS will see additional state funding in FY2022, and due to the EBF distribution construct, the additional amount will become the base for CPS’ appropriation in FY2023.

The federal government’s response to the pandemic through the passage of ESSER I, II, and III has allocated a historic level of federal funding to CPS.1 The one-time revenue has been budgeted to support Moving Forward Together––the district’s plan to combat the effects of the pandemic on student achievement and well-being––and offset lost revenue and increased costs resulting from the pandemic. The federal aid packages have resulted in allocations totaling $2.8 billion over five fiscal years beginning in FY2020. Without this financial relief, it would not have been possible to manage the costs incurred from meeting the technological needs of remote instruction and ensuring school buildings are equipped to welcome back students and educators safely.

Along with this one-time relief, President Biden’s FY2022 budget request for the Department of Education increases Title I by $20 billion and Individuals with Disabilities Education Act (IDEA) funding by $2.6 billion.2 While the final appropriations will depend on congressional action, the prospect and need for an increase to structural federal revenue should not go unmentioned.

The following section details the factors, assumptions, and trends that are the basis of the FY2022 revenue budget.

| FY2021 Budget |

FY2021 Projected End of Year | FY2022 Budget | FY2022 vs. FY2021 Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,264.9 | $3,232.7 | $3,374.2 | $109.3 |

| Replacement Tax | $194.9 | $281.9 | $234.9 | $40.0 |

| Other Local | $570.9 | $557.5 | $553.5 | ($17.4) |

| Total Local | $4,030.8 | $4,072.1 | $4,162.6 | $131.8 |

| State Revenues | ||||

| EBF | $1,665.8 | $1,657.8 | $1,705.8 | $40.0 |

| Capital | $47.3 | $14.1 | $23.3 | ($24.0) |

| Other State | $625.7 | $625.7 | $602.2 | ($23.4) |

| Total State | $2,338.7 | $2,297.6 | $2,331.3 | ($7.4) |

| Federal | $1,336.7 | 1,218.8 | $2,107.9 | $771.2 |

| Investment Income | $0.5 | $2.5 | $0.1 | ($0.4) |

| Reserves | $22.0 | $22.0 | $10.0 | ($12.0) |

| Total Revenue | $7,728.6 | $7,613.0 | $8,611.8 | $883.2 |

| FY2022 Total Budget | Amount for Debt Service | Amount for Capital | Balance for Operating Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,374.2 | $51.1 | $5.0 | $3,318.1 |

| Replacement Tax | $234.9 | $39.4 | $0.0 | $195.5 |

| Other Local | $553.5 | $142.3 | $14.0 | $397.2 |

| Total Local | $4,162.6 | $232.8 | $19.0 | $3,910.8 |

| State Revenues | ||||

| EBF | $1,705.8 | $480.4 | $0.0 | $1,225.3 |

| Capital | $23.3 | $0.0 | $23.3 | $0.0 |

| Other State | $602.2 | $0.0 | $0.0 | $602.2 |

| Total State | $2,331.1 | $480.4 | $23.3 | $1,827.6 |

| Federal | $2,107.9 | $24.7 | $10.0 | $2,073.1 |

| Investment Income | $0.1 | $0.0 | $0.0 | $0.1 |

| Reserves | $10.0 | $0.0 | $0.0 | $10.0 |

| Total Revenue | $8,611.8 | $738.0 | $52.3 | $7,821.6 |

| FY2021 Operating Budget | FY2021 Estimated End of Year | Variance Estimated vs Budget | FY2022 Operating Budget | FY2022 vs. FY2021 Budget | |

|---|---|---|---|---|---|

| Property Tax | $3,204.0 | $3,171.8 | ($32.2) | $3,318.1 | $114.1 |

| Replacement Tax | $155.5 | $242.5 | $87.0 | $195.5 | $40.0 |

| TIF Surplus | $96.9 | $126.9 | $30.0 | $136.9 | $40.0 |

| All Other Local | $289.6 | $289.6 | - | $260.3 | ($29.3) |

| Total Local | $3,745.9 | $3,830.7 | $84.8 | $3,910.8 | $164.9 |

| State Aid | $1,578.9 | $1,570.8 | ($8.0) | $1,549.6 | ($29.3) |

| State Pension Support | $266.9 | $266.9 | - | $278.0 | $11.1 |

| Total State | $1,845.8 | $1,837.8 | ($8.0) | $1,827.6 | ($18.2) |

| Federal | $1,301.8 | $1,193.0 | ($108.8) | $2,073.1 | $771.3 |

| Investment Income | $0.5 | $0.5 | - | $0.1 | ($0.4) |

| Reserves | $22.0 | $22.0 | - | $10.0 | ($12.0) |

| Total Revenue | $6,916.0 | $6,884.0 | ($32.0) | $7,821.6 | $905.6 |

Local Revenues

Property Taxes

CPS is projected to receive $3,374.2 million in property tax revenues in FY2022, which remains the district’s largest single revenue source. Of the total property tax revenue, $56.1 million is revenue from the Capital Improvement Tax levy, which includes $51.1 dedicated to paying debt service on bonds issued for capital improvements and $5 million in additional levy receipts. Within the operating budget, CPS projects to receive $463.8 million from the dedicated Chicago Teacher Pension Fund (CTPF) levy, leaving $2,854.5 billion left for all other operating costs.

Of the $2,854.5 billion, $2,711.3 billion is from the CPS property tax education levy, $78.3 million is revenue from Transit Tax Increment Financing (TIF), and an anticipated additional $65 million is from proposed changes to the property tax code from Senate Bill 0508.

The FY2022 budget includes an increase to property taxes of $114 million from the FY2021 budget, $76.8 million of which comes from an increase in CPS’ education levy. To calculate the increase in revenue from the education levy, an estimate of the change to the previous year value of taxable property was made. In prior years, this information was publicly available through the Cook County tax agency report. At the time of writing, the final Equalized Assessed Value (EAV) for tax year 2020 is not available. Based on the assumed FY2021 final levy amounts and property values, the increase in the education levy includes roughly $38 million from increasing the education levy by the rate of inflation of 1.4 percent, and roughly $39 million from the $608.8 million in new property that is projected to be included in the 2021 tax bill and the $963.2 million in projected TIF district expiries.

In addition to the increases from the education levy, Senate Bill 05083 legislation passed by the General Assembly is (at the time of publication) awaiting the Governor’s signature and anticipated to provide CPS with approximately $65 million in property tax funding in FY2022. The legislation allows Illinois school districts to receive the amount of property tax levied but not received due to property tax bill refunds processed through the state treasurer’s office.

Offsetting the increase to CPS’ projected education levy revenue is a drop in projected revenue from CPS’ pension levy. Due to the impact of off-cycle property value reassessments, described below, CPS anticipates a $26.4 million decrease in projected pension levy collections. Transit TIF collections are projected to be down by just over $1 million dollars due to the anticipated decline in property value in the TIF district.

Impact of Inflation

CPS’ property tax levy is subject to PTELL, or the Property Tax Extension Limitation Law. PTELL limits the amount government agencies, or in this case, school districts, can extend or collect from a taxing district. Each year, CPS levies property taxes to fund the operations of the public school system. The amount that CPS requests, through the Board of Education, cannot reflect an increase greater than the change in the Consumer Price Index (CPI) or 5 percent. Tying tax increases to CPI is intended to prevent taxpayers from being overburdened by government activity that is irrespective of larger economic trends and has subsequent impact to taxpayers.

The Illinois Department of Revenue is responsible for publishing the CPI that will be used for any government unit subject to PTELL. For the FY2022 property tax levy calculation, the CPI applied to the FY2021 extension is 1.4 percent4. This inflation rate is lower than the previous year’s rate of 2.3 percent. While a slowdown in CPI was anticipated because of the economic downturn associated with COVID-19, the 1.4 percent represents the lowest increase in inflation in the past five years.

Impact of Assessments

The Cook County Assessor’s office reassess property values on a triennial cycle. The last cyclical reassessment for City of Chicago property values happened in tax year 2018. However, due to the impact of COVID-19 on the economy, Assessor Fritz Kaegi’s office performed an off-cycle evaluation for the City of Chicago in March and April 2020 to help ensure that property owners were not overly burned by tax bills during a period of high unemployment, downturns in the commercial market, and the stay at home mandates ordered by Governor Pritzker. This reassessment has led to reductions in assessed value in residential and commercial properties5. The FY2022 budget includes an estimated 6.8 percent drop in citywide EAV due to this reassessment, which has driven an overall decrease in pension levy receipts as described above.

The city will undergo its regular reassessment in 2021, though forecasting the impact of the reassessment is challenging not only because of the off-cycle COVD-19 reassessment but also because Assessor Kaegi’s office has publicly shared that assessments prior to Kaegi taking office have been historically inaccurate and were not equitably or fairly distributing the tax burden to different neighborhoods and communities throughout the County, specifically throughout Chicago. The FY2022 budget includes an estimated growth of 8 percent in citywide EAV due to the scheduled 2021 reassessment.

Impact of New Property

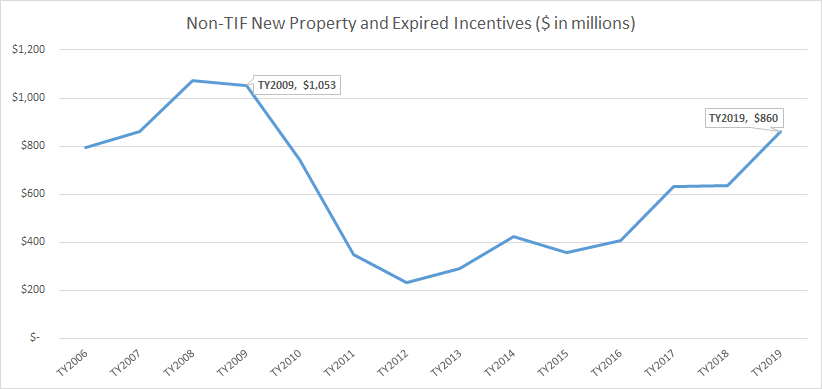

As explained earlier, CPS, under PTELL, is able to increase its property tax levy on existing taxable properties at the rate of inflation. Property that was either constructed during a given tax year, or newly taxable as part of the incremental value of an expired TIF district, is not included in the base property amount that the CPI is applied to each year. Both new property and the incremental equalized assessed value (EAV) of an expiring TIF district are taxed at the same rate as existing properties.

In tax year 2021, an anticipated amount of $608.8 million of newly constructed property and $963.2 million of incremental TIF EAV will be taxed and subsequently become part of the 2022 tax base.

Chart 1: Non-TIF New Property in Chicago, Tax Years 2006-20196

Other Property Tax Considerations

A smaller portion of CPS operating revenues is generated by the TIF district created for the Red-Purple Modernization Program (Transit TIF) on the North side of Chicago to modernize Chicago Transit Authority (CTA) tracks from North Avenue to Devon Avenue. By statute, CPS is due approximately 52 percent of all incremental value produced in the Transit TIF. In FY2022, CPS projects that Transit TIF revenues will be $78.3 million, representing a slight reduction of just over $1 million from the FY2021 revenue budget of $79.3 million. While 2021 is a reassessment year and will increase property tax collections in FY2022, the impact of the County Assessor's 2020 off-cycle reassessment means that 8 percent anticipated increase in FY2022 is bringing property values to a level nearly flat to the original FY2021 anticipated value.

Personal Property Replacement Taxes (PPRT)

Personal Property Property Replacement Taxes (PPRT) are collected by the state of Illinois and distributed to local governments state-wide. While the tax rates behind the collections are constant, the amount of funding CPS receives from this revenue can vary significantly from year to year. This is because PPRT is a tax that businesses and partnerships, trusts, and S corporations pay on their net Illinois income, along with a tax that public utilities pay on invested income. As corporate and investment income fluctuates, so does the amount received by local government agencies, including CPS.

The collection rates, found below, are greatest for the CIT and are therefore used to provide the basis of the CPS revenue budget.

- Corporations pay a 2.5 percent replacement tax on their net Illinois income.

Partnerships, trusts, and S corporations pay a 1.5 percent replacement tax on their net Illinois income. - Public utilities pay a 0.8 percent tax on invested capital.7

Prior to the late 1970’s, local governments and school districts were statutorily allowed to levy taxes on business properties. After the General Assembly revoked that ability, legislation instituting PPRT was passed to mitigate the revenue loss to local taxing agencies. The portion of PPRT disbursed to Illinois local government agencies reflects the amount collected in tax year 1977. For CPS, the portion of collected PPRT distributed is 14 percent.

In FY2022, Personal Property Replacement Tax (PPRT) receipts are budgeted to increase by $40 million from FY2021. As discussed throughout this chapter, the FY2021 revenue budget was developed during a time of great economic uncertainty due to the impact of COVID-19 on employment, the housing market, and consumer spending. PPRT is outperforming the FY21 revenue budget, and this trend is anticipated to continue into FY2022. With debt service payments from PPRT remaining at their FY2021 level of $39.4 million, the operating budget for PPRT is $195.5 million for FY2022.

This increase reflects the state of Illinois Corporate Income Tax (CIT) estimates from the state’s Office of Budget and Management that anticipate year-over-year growth of 16.7 percent due in part to proposed changes to both federal and state tax code.8 The growth is net the amount of CIT disbursed after diversions to the refund fund and the amount diverted by the Governor for the local government distributive fund. The refund fund deposit is a percentage established by the Illinois Department of Revenue to fund corporations' requests for refunds from CIT taxes collected.

TIF Surplus and Other Local Resources

CPS expects to receive $136.9 million in TIF surplus funding in FY2022, exceeding the $96.9 million budgeted in FY2021 by $40 million. In October 2020, the City of Chicago’s 2021 budget was approved and included a declaration of TIF surplus funding of a historic $304 million.9

State law requires that surplus funds are proportionally distributed to the taxing bodies within the districts. The surplus declaration in the city’s FY2021 budget directs $176 million in TIF district property tax revenue to CPS, $70 million above the district’s original estimate of $96.9 million. However, because the City of Chicago and CPS fiscal years do not align, CPS anticipates $40 million of of $70 million to be utilized in CPS fiscal year 2022, growing the FY2021 CPS original budget amount of $96.9 million to $126.9 million and the providing an anticipated FY2022 surplus of $136.9 million.

“All other local” revenue includes the pension payment made by the City of Chicago on behalf of CPS for their employer contribution to the Municipal Employees’ Annuity and Benefit Fund (MEABF), which is estimated to be $115 million in FY2022. Though CPS recognizes revenue to reflect the portion of the expense covered by the city, FY2022 marks the third year that CPS is absorbing some of the pension costs of its non-teaching staff. Prior to FY2020, the City of Chicago paid CPS’ entire MEABF employer contribution, but CPS now bears $100 million of that cost to offset the city’s contribution on behalf of CPS employees.

Local Contributions to Capital

FY2022 local capital revenue of $19 million assumes $4 million in TIF-related project reimbursements and $10 million from other local funding sources such as aldermanic menu funds, the Metropolitan Water Reclamation District, and $5 million from CIT property tax collections not tied to existing bond issuances.

State Revenue

In FY2022, CPS’ state revenue budget is $2,331.3 million, which comprises 27.1 percent of CPS’ total budget. As discussed above, the state provides funding to CPS through Evidence-Based Funding and several smaller appropriations that come in the form of reimbursable or block grants.

Evidence-Based Funding

EBF is the largest portion of funding that CPS receives from the state of Illinois In FY2022. EBF represents roughly 73 percent of the $2,331.1 million that CPS is projected to receive from the state.

Since its inception in 2017, the state has allocated EBF funds to districts using a formula that maintains existing funding levels for all districts and targets new funding to the districts that are least well-funded. The formula first allocates each district its Base Funding Minimum, a total reflecting the previous year’s EBF allocation. This provision provides crucial stability for CPS as it ensures that, regardless of enrollment or demographic trends, CPS will receive at least the same funding as the year prior. (The only scenario that could potentially drive a year over year decrease in funding is if the state took the unprecedented and highly unlikely step of disinvesting from EBF funding.)

The second component of the formula allocates new, or “tier,” funding based on a formula that targets the least well-funded districts. To evaluate funding levels of districts across the state, the state first calculates “adequacy targets” for each district, reflecting the evidence-based level of resources needed for each district to educate its students. Adequacy targets, for example, include the additional resources necessary to educate low-income students, special education students, and English Language learners, along with the financial resources needed to provide funding for technological devices and instructional materials. (FY2021 was the only year since inception that new tier funding was not added to the EBF distribution.)

Funding adequacy, expressed as a percentage, is then calculated by dividing each district’s available local resources by its adequacy target, indicating each district’s ability to meet its specific needs. The FY2020 calculations, the most recent calculations currently available, indicate that CPS’ funding adequacy is 65.5 percent.

Tier funding is then distributed using a formula that allocates the most funding to “Tier 1” schools, or those least adequately funded. CPS has been a Tier 1 school since the inception of EBF, reflecting the high-needs of the district and historical levels of underfunding. At the time of publication, the Illinois State Board of Education (ISBE) has not publicly shared updated tier designations. CPS anticipates remaining in Tier 1 for the foreseeable future and receiving an additional $58 million in tier funding in FY2022. While tier designations rely on enrollment attributes of all districts throughout the state, the recent passage of SB 081310 provides additional assurance that CPS will remain Tier 1. This legislation holds harmless the enrollment totals used in adequacy target calculations, ensuring pandemic-driven enrollment losses do not decrease adequacy targets and drive districts to a higher tier.

Since 2019, CPS has received an additional allocation of EBF funding that is the result of property tax adjustments. This amount totals just over $16 million and is included in the total EBF funding amounts.

State Contribution to Teacher Pensions

FY2022 is the fifth consecutive year that CPS has benefited from the state of Illinois making payments to the Chicago Teacher Pension Fund (CTPF). While the state contributions help to offset the impact that CTPF has on CPS’ financial health, Chicago remains the only district in Illinois that is required to pay contributions to the district teacher pension fund. In FY2022, the state contribution to CTPF is $277.5 million, an increase of 10.6 million from the prior year contribution of $266.9 million. See the Pension chapter for more information.

Additional State Funds including Categorical Grants

In addition to EBF and teacher pension contributions, CPS is projected to receive an additional $340.5 million in revenue from state appropriated funds and categorical grants. The majority of this funding is from the Early Childhood block grant, which remains flat at $201 million for the third consecutive year. While state appropriations are flat from FY2021 to FY2022, the total budgeted revenue in this category reflects a slight decrease from FY2021 as a result of additional carryover in FY2021 due to school buildings closing in spring 2020.

State Contribution for Capital

The state revenue total of $23.3 million comprises $13.3 million in gaming revenue for new construction projects and $10 million in other potential state grants.

Federal Revenue

Most federal grants require the Chicago Board of Education to provide supplemental educational services for children from low-income households, children from non-English speaking families, and for neglected and delinquent children from preschool through twelfth grade. These grants are dedicated to specific purposes and cannot supplant local programs. Medicaid reimbursement and Impact Aid are the only federal funding that is without any restriction.

Every Student Succeeds Act (ESSA)

- Title I-A—Low Income: Allocated based on a district’s poverty levels, this is the largest grant received under the ESSA. The grant allows the district to provide supplemental programs to improve the academic achievement of low-income students. CPS estimates that the district will receive $216.9 million in Title I funding in FY2022. This includes an anticipated reduction of $5.6 million in the formula-based Title I grant from FY2021 to FY2022. The anticipated total grant award for FY2022 is $257.2 million, which includes allowable carryover of $40 million from the previous year.

- Title I-A—IL Empower: This grant is a state-wide system of differentiated support and accountability to improve student learning, purposely designed to develop capacity to meet student needs. CPS anticipates a grant award of $34.6 million in FY2022, which includes a carryover of $9.2 million from the previous year.

- Title I-D—Neglected/Delinquent: This grant targets the educational services for neglected or delinquent children and youth in local and state institutions to assist them in attaining state academic achievement standards. Programs include academic tutoring, counseling, and other curricular activities. The anticipated total grant award for FY2022 is $2.4 million, which includes allowable carryover of $1 million from the previous year.

- Title II-A—Improving Teacher Quality: This grant funds class size reduction, recruitment and training, mentoring, and other support services to improve teacher quality. CPS anticipates a total of $27.1 million to be awarded for the FY2022 Title II-A grant, which includes a current award of $17.4 million and an estimated $7.6 million in carryover from the previous year.

- Title III-A—Language Acquisition: These funds support students with limited English proficiency who meet eligibility requirements. The total funding available is estimated at $8.4 million for FY2022, which does not include carryover from the previous year.

- Title IV-A—Student Support and Academic Enrichment Grants: These grants support states, local educational agencies, schools, and local communities to provide all students with access to a well-rounded education, improved student learning conditions in schools, and increased technology in order to improve the academic achievement and digital literacy of all students. CPS anticipates a total of $27.9 million to be awarded for the FY2022 Title IV-A grant, which includes a carryover of $11.7 million from the previous year.

- Title IV-B—21st Century Community Learning Centers: These grants provide opportunities for communities to establish schools as community learning centers and provide activities during after-school and evening hours. CPS anticipates a total of $10.6 million to be awarded in FY2022, an increase of $1.2 million from the previous year.

- Title VII-A—Indian Education: Funds from this grant are used to meet the educational and cultural needs of American Indian and Alaska Native students. The grant award is expected to stay level at $229,367 for FY2022.

Individuals with Disabilities Education Act (IDEA)

IDEA grants are allocated based on a state-established formula to provide supplemental funds for special education and related services to all children with disabilities from ages three through 21.

The IDEA grants include a number of programs:

- IDEA Part B Flow-Through: This is the largest IDEA grant, with the estimated award for FY2022 totaling $100.4 million.

- IDEA Room and Board: This grant provides room and board reimbursement for students attending facilities outside of Chicago and is estimated at $6.7 million in FY2022.

- Part B Preschool: This grant offers both formula and competitive grants for special education programs for children ages 3–5 with disabilities. CPS is expected to stay level at $1.3 million from the formula grant and $489,250 from a competitive grant for FY2022.

Total FY2022 IDEA funding equals $108.8 million, including small competitive grants and carryover from the previous year in the preschool grant.

National School Lunch Program & Child and Adult Care Food Program

Child Nutrition Programs

CPS participates in state- and federally-funded Child Nutrition Programs, including the:

- School Breakfast Program (SBP)

- National School Lunch Program (NSLP)

- Child and Adult Care Food Program (CACFP)

- Summer Food Service Program (SFSP)

- Fresh Fruit and Vegetable Program (FFVP)

Under the Child Nutrition Programs (CNP), CPS offers free breakfast, lunch, after-school supper, after-school snacks, Saturday breakfast, and Saturday lunch during the school year. The district also serves breakfast and lunch during summer school and offers fresh fruit and vegetables to elementary school students during the school year.

In 2012, CPS began participating in the Community Eligibility Provision program. All schools now are part of this program, which provides free breakfast and lunch to all students regardless of income eligibility. CPS is reimbursed for all meals at the maximum free reimbursement rate under each CNP.

CPS anticipates $214 million in federal reimbursements for FY2022. These revenues include:

- $202 million for school lunches, breakfast, snacks, and donated foods

- $9.9 million for CACFP

- $1.8 million for FFVP

Medicaid Reimbursement

Local Education Agencies (LEAs) are required to provide special education and related services as delineated in the Individualized Education Program (IEP) or Individualized Family Service Plan (IFSP) at no cost to parents. Medicaid provides reimbursement for the:

- Delivery of covered direct medical services provided to eligible children who have disabilities in accordance with the Individuals with Disabilities Education Act (IDEA), as outlined in the student’s IEP; and the

- Cost of specific administrative activities, including outreach activities designed to ensure that students have access to Medicaid-covered programs and services.

Medicaid provides reimbursement for covered direct medical services including audiology, developmental assessments, medical equipment, medical services, medical supplies, medication administration, nursing services, occupational therapy, physical therapy, psychological services, school health aid, social work, speech/language pathology, and transportation. When these services are provided to Medicaid enrolled students with IEPs, the services are eligible for Medicaid reimbursement at the state’s reimbursement rate, approximately half of the established cost to provide the service.

Medicaid revenues in FY2022 are projected to be $35.4 million, subject to the level of health care services rendered in the upcoming school year. FY2022 Medicaid revenues are strengthened by continued revenue retention initiatives focused on enrolling eligible students in Medicaid, improving service capture, maximizing claiming and billing processes, and ensuring all claimable costs are reimbursed. New policy initiatives at the state level are expected to expand the types of services and service providers for which CPS is able to seek reimbursement from the state.

Other Federal Grants

This category includes competitive grants for other specific purposes, including:

- Carl D. Perkins: This grant was established to help students in secondary and post-secondary education develop academic and technical skills for career opportunities, specific job training, and occupational retraining. The FY2022 Perkins formula grant is anticipated to be $7.5 million, which includes an estimated rollover of $1.9 million.

- E-rate: The Federal Communications Commission provides funding through its E-rate program to discount the cost of telecommunications, internet access, and internal connections for schools and libraries across the country. The FY2022 Federal E-rate grant is anticipated to be $5.0 million.

Elementary and Secondary School Emergency Relief Funding

In response to the COVID-19 pandemic and its subsequent impact on school districts throughout the country, the federal government has taken steps to support new pandemic-related costs and provide funding relief for impacted revenues through three rounds of emergency funding.

The first round of Elementary and Secondary School Emergency Relief funding (ESSER I) was allocated to school districts through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed by Congress in March 2020. CPS received $206 million in ESSER I funding that was used to support costs in the FY2020 and FY2021 budgets, allowing the district to support emergency remote learning and school reopening costs required by the onset of the pandemic.

Congress passed the second round of relief funding (ESSER II) in December 2020, through which CPS is slated to receive $797 million over the course of FY2021 and FY2022. At the time CPS passed its FY2021 budget (August 2020), this funding had not yet been authorized. With indications that another relief package was pending, CPS budgeted $343 million in FY2021 to support additional remote learning and school reopening costs, allowing the district to fulfill its commitments to fully fund FY2021 school budgets, maintain existing priority investments, and meet contractual obligations. The passage of ESSER II in December gave the district the revenue necessary to make good on these FY2021 commitments with additional funds leftover to support FY2022 costs. CPS is projected to utilize $339 million of this funding in FY2021, leaving $458 million left to support investments in the FY2022 budget.

The final, most significant round of federal funding came in April 2021 with Congressional approval of the American Rescue Plan, within which a third round of ESSER funding (ESSER III) will direct nearly $1.8 billion to CPS. This funding will be available through the summer of 2024 and, similar to ESSERs I and II, will provide funding necessary to combat the effects of the pandemic on learning loss and social and emotional well-being of students, safely open schools, and replace lost revenues. The FY2022 budget includes $602 million of ESSER III funding.

The FY2022 budget’s combined $1.06 billion of ESSER II and III funding is aligned to investments in the three ESSER priority areas: 1) emerging stronger post-pandemic, with a focus on a safe return to in-person instruction; 2) maintaining continuity of service including maintaining staffing and adding additional resources in schools, and 3) resource equity addressing the disproportionate impact of COVID-19 on communities of color and communities experiencing poverty. A detailed list of investments is included in the budget overview chapter.

Federal Contribution for Capital

CPS expects to receive roughly $10 million in federal funding for capital from reimbursements of ESSER III funded projects included in the FY2022 capital plan.

Federal Interest Subsidy under Qualified School Construction Bonds (QSCBs) and Build America Bonds (BABs)

In FY2022, CPS has budgeted to receive a direct federal subsidy payment of $25 million for these two types of federally-subsidized bonds. This amount takes into consideration an allowance assumption of 5.7 percent for federal sequestration, down from 5.9 percent in our FY2021 assumptions. See the Debt Management chapter for more information.

- https://oese.ed.gov/offices/education-stabilization-fund/elementary-secondary-school-emergency-relief-fund/

- https://www2.ed.gov/about/overview/budget/budget22/budget-highlights.pdf

- https://www.ilga.gov/legislation/BillStatus.asp?DocNum=508&GAID=16&DocTypeID=SB&SessionID=110&GA=102

- https://www2.illinois.gov/rev/localgovernments/property/Documents/cpihistory.pdf

- https://prodassets.cookcountyassessor.com/s3fs-public/form_documents/COVIDNorthCityTris.pdf?a5GWzQItRiC7CSjYU6lOorVX1SkYlBCE=

- At the time of writing the Cook County tax agency report for tax year 2020 is not publicly available.

- https://tax.illinois.gov/localgovernments/personal-property-replacement-tax.html

- https://budget.illinois.gov/content/dam/soi/en/web/budget/documents/budget-book/fy2022-budget-book/fiscal-year-2022-operating-budget.pdf, pg 149

- https://www.chicago.gov/content/dam/city/depts/obm/supp_info/2021Budget/2021OVERVIEWFINAL.pdf, pg 61

- https://www.ilga.gov/legislation/BillStatus.asp?DocNum=813&GAID=16&DocTypeID=SB&SessionID=110&GA=102